Why a Financial “Panic” May Be Just Around the Corner

Here’s why global investors should keep a close eye on “sight deposits”

By Elliott Wave International

Investors look to an array of indicators in hopes of determining what is next for the financial markets in which they are interested.

Some investors may focus entirely on “technical” indicators such as the Relative Strength Index (RSI), price levels of “support” or “resistance,” or say, advancing vs. declining issues, just to name a few. As you probably know, there are many more technical indicators.

Market participants also look at sentiment readings such as mutual fund cash levels, investors’ use of leverage, surveys and so on.

Yet, there’s at least one indicator that many global investors may overlook, and that’s the weekly change in “sight deposits” at the Swiss National Bank.

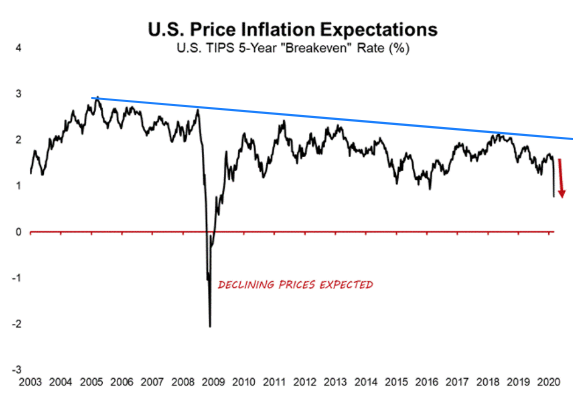

This chart and commentary from the September Global Market Perspective, an Elliott Wave International publication which offers coverage of 50+ worldwide financial markets, provide insight:

For the week ending August 6, commercial banks poured 1.2 billion francs into the Swiss National Bank, the largest weekly inflow since mid-June. The cash that banks park at the central bank are called “sight deposits,” and, together, the June and August data points represent the largest weekly inflows since the coronavirus panic in early 2020.

The previous spikes on the chart show why we keep such a close eye on sight deposits. Bank officials move cash into the SNB when fear swells, and they pull cash back out when complacency returns.

So, it does appear that fear is starting to develop among bankers.

As the September Global Market Perspective goes on to say:

With total sight deposits pushing to an all-time record of 713 billion francs last month, bank officials seem all too happy to park their money at the central bank. Perhaps they know something that the average meme stock investor doesn’t.

Elliott Wave International’s global analysts will continue to monitor sight deposits along with other indicators, plus, the Elliott wave structure of 50+ global financial markets.

Indeed, the September Global Market Perspective shows a chart with the Elliott wave patterns of two major global stock indexes. The chart’s headline is “The Alarm Bells Are Ringing.“

If you need to brush up on your knowledge of Elliott wave patterns, or you are new to Elliott wave analysis, you are encouraged to read the Wall Street classic: Elliott Wave Principle: Key to Market Behavior, by Frost & Prechter.

Here’s a quote from the book:

In its broadest sense, the Wave Principle suggests the idea that the same law that shapes living creatures and galaxies is inherent in the spirit and activities of men en masse. Because the stock market is the most meticulously tabulated reflector of mass psychology in the world, its data produce an excellent recording of man’s social psychological states and trends. This record of the fluctuating self-evaluation of social man’s own productive enterprise makes manifest specific patterns of progress and regress. What the Wave Principle says is that mankind’s progress (of which the stock market is a popularly determined valuation) does not occur in a straight line, does not occur randomly, and does not occur cyclically. Rather, progress takes place in a “three steps forward, two steps back” fashion, a form that nature prefers.

If you’d like to read the entire online version of the book, you can do so by becoming a Club EWI member. Club EWI is the world’s largest Elliott wave educational community and is free to join. You are under no obligation as a Club EWI member. Yet, members do enjoy complimentary access to a wealth of useful Elliott wave resources on financial markets, investing and trading.

Join Club EWI and get free access to the book by following this link: Elliott Wave Principle: Key to Market Behavior.

This article was syndicated by Elliott Wave International and was originally published under the headline Why a Financial “Panic” May Be Just Around the Corner. EWI is the world’s largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.